Back to the Learning Academy.

Sustainability at the Board and Executive Team Level: An Analysis of TSX-Listed Companies

On The Board | A 4-part series

On The Board is a 4-part series of data-driven insights and analysis based on company research of public companies listed on Toronto Stock Exchange

- Part 1: Overboarding: An Analysis on Toronto Stock Exchange Listed Companies

- Part 2: Sector Analysis of Board Diversity

- Part 3: Diversity of Executive Management Teams

- Part 4: Sustainability at the Board and Executive Team Level

*Unless otherwise indicated, statistics compiled and provided by MarketIntelWorks On The Board Tracker.

Part 4 | Sustainability at the Board and Executive Team Level: An Analysis of TSX-Listed Companies

What Does Sustainability Mean in Business?

Over the last several years, sustainability has come to the forefront at corporations around the world. Stakeholders are asking companies to integrate sustainability into their strategies and everyday business operations. What does sustainability mean? "In business, sustainability refers to doing business without negatively impacting the environment, community, or society as a whole."1

With increased focus on sustainability comes increased need to have sustainability expertise at both the executive management team level and the board level. In fact, the Canadian Securities Administrators Proposed National Instrument NI 51-107 Disclosure of Climate-related Matters, which if mandated, would require TSX-listed companies to describe the board's oversight of climate-related risks and opportunities. Further, the National Instrument would also ask for management's role in assessing and managing climate-risks and opportunities.2

Chief Sustainability Officer (CSO) is a title that has started showing up on executive management teams, and further, sustainability committees on boards have begun to be formed. The focus of this article and analysis will be on sustainability at the board and executive management team level of TSX-listed companies.

Current Sustainability Leadership Statistics:

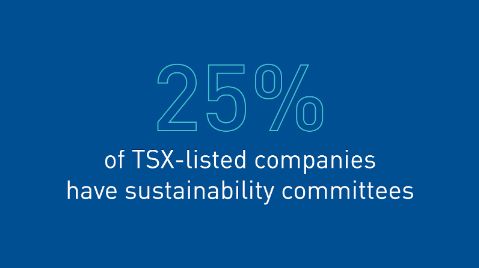

Sustainability, which encompasses environmental, social, and governance (ESG) issues, is increasingly being placed at the top of board and executive management agendas and as a result, the number of sustainability committees on boards is increasing, as well as the number of executives with sustainability-focussed roles.

As at December 31, 2022, of the 783 TSX-listed companies, 196 or 25% have sustainability committees within their boards and 139 or 18% have sustainability roles on their executive management teams. Seventy-six, or 10% have sustainability representation at both the board level and the executive management team level. In the S&P/TSX Composite Index*, out of 235 companies, 100 or 45% have sustainability committees within their boards and 68 or 29% have sustainability roles on their executive management teams. These numbers are encouraging in that there is a healthy percentage of companies that have sustainability committees at the board level. The executive level sustainability representation, while lower than the board's representation, is also encouraging. By comparison, in a global study analyzing 1,640 companies, PwC found around 30% had a formal CSO role and another 50% of the companies had a CSO with limited remit.3

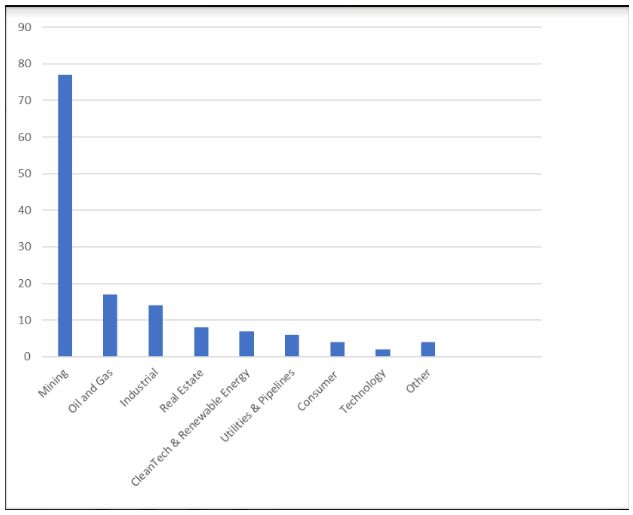

Sustainability Representation (#) on Boards by Sector

As at December 31, 2022

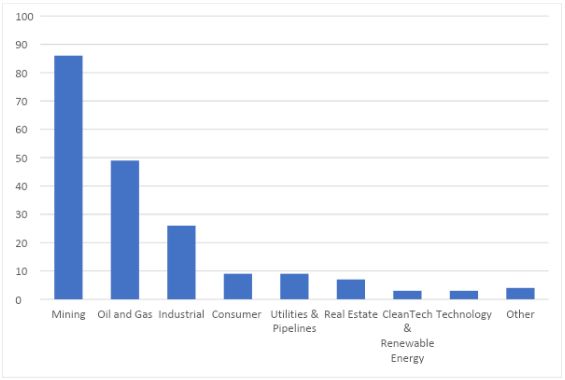

Sustainability Representation (#) on Executive Management Teams by Sector

As at December 31, 2022

It is not surprising that the mining, oil and gas and industrial sectors are the top three sectors by number of sustainability representation for both boards and executive management teams. These sectors are under more ESG oversight by investors, regulators, governments, the media and NGOs. (Footnote 4)

The Role of the Sustainability Executive

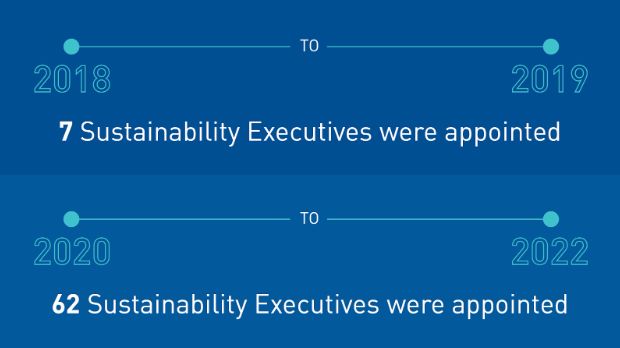

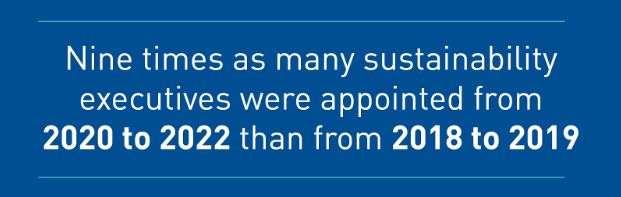

The number of CSOs at corporations globally is increasing at a rapid pace. In 2020 to 2021, global companies appointed as many CSOs as in all prior eight years combined.

By the end of December 2022, twenty-seven companies on TSX had a CSO on their executive team. For the remaining companies, the role is varied by title (EVP, SVP, VP or Director) and falls under different functions. Some companies have added sustainability to the title of the human resources executive, the finance executive, the chief legal counsel or to the communications executive. Because the role is new and is expanding beyond the compliance-only job description, many companies are still working out the best title and department for the sustainability executive. One thing is clear, however – "companies with CSOs are better ESG performers. A study by PwC reviewed the ESG rating from Refinitiv for 1,455 companies: Among the companies that scored an A-rating, almost all (98%) had an executive with at least some sustainability responsibility."5

Recent proxy resolutions have not gone so far as to push for naming someone to a sustainability role or to set up a board sustainability committee. However, boards are being held to higher standards around sustainability and investors will look closely at boards, corporate leadership, and incentive structures as they cast their proxy votes in 2023 and beyond.6 Just as companies are held to standards around diversity on boards, it is possible that a requirement of at least one sustainability expert sitting on the board of directors could emerge. With demands for corporate sustainability coming from the full range of stakeholders (investors, consumers, supply chain partners, government regulators, and employees), it is expected and predicted that the numbers of sustainability executives on boards and on management teams will grow over the next few years.7 As more companies have a sustainability strategy pillar that underpins all aspects of their organization, more sustainability experts will need to be appointed.

For related content, take a look at the resources below:

- A Guide to Effective Climate Governance For Venture Issuers in the Mining Sector

- Proxy Insights 2022 article

- Our ESG Disclosure session through our Growth Accelerator Education Program

About MarketIntelWorks

Gina Pappano is the Founder of MarketIntelWorks Inc., a data research and analytics company with a focus on gender diversity plus BIPOC (Black, Indigenous, People of Colour) on Boards and Executive Management Teams of TSX listed companies. MarketIntelWorks On The Board Tracker is a comprehensive diversity tracking tool in Canada. Not only do we have the stats with respect to Gender, Visible Minority, Indigenous and Black representation on Boards and Executive Teams, we also have the names of the people behind the stats. Marketintelworks.com

Footnotes:

-

Spiliakos, Alexandra. "What Does "Sustainability" Mean in Business?" HBS Online, Business Insights Blog, October 10, 2018. https://online.hbs.edu/blog/post/what-is-sustainability-in-business

-

Canadian Securities Administrators. Consultation Climate-related Disclosure Update and CSA Notice and Request for Comment Proposed National Instrument 51-107 Disclosure of Climate-related Matters, October 18, 2021. https://www.osc.ca/sites/default/files/2021-10/csa_20211018_51-107_disclosure-update.pdf

-

PwC. "Empowered Chief Sustainability Officers". Copyright 2022. https://www.strategyand.pwc.com/de/en/functions/esg-strategy/empowered-chief-sustainability-officers.html

-

PwC. "Empowered Chief Sustainability Officers". Copyright 2022. https://www.strategyand.pwc.com/de/en/functions/esg-strategy/empowered-chief-sustainability-officers.html

-

Morningstar Sustainalytics. "Key Themes Shaping Proxy Voting in 2022". Published March 11, 2022.

https://www.sustainalytics.com/esg-research/resource/investors-esg-blog/themes-proxy-voting-2022 -

Rafi, Talal. "Why Corporate Boards Need Sustainability Experts". London School of Economics Business Review Blog, July 20, 2022. https://blogs.lse.ac.uk/businessreview/2022/07/20/why-corporate-boards-need-sustainability-experts/

Copyright © 2023 TSX Inc. All rights reserved. Do not copy, distribute, sell or modify this document without TSX Inc.'s prior written consent. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this article, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This article is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities listed on Toronto Stock Exchange and/or TSX Venture Exchange. The Future is Yours to See., TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX and Voir le futur. Réaliser l'avenir. are the trademarks of TSX Inc.

*The S&P/TSX Composite Index (the "Index") is the product of S&P Dow Jones Indices LLC or its affiliates ("SPDJI") and TSX Inc. ("TSX"). Standard & Poor's® and S&P® are registered trademarks of Standard & Poor's Financial Services LLC ("S&P"); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC ("Dow Jones"); and TSX® is a registered trademark of TSX. SPDJI, Dow Jones, S&P, their respective affiliates and TSX do not sponsor, endorse, sell or promote any products based on the Index and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions or interruptions of the Index or any data related thereto.