Back to the Learning Academy.

An Introduction To The Voluntary Carbon Market

The market for voluntary carbon offsets is by no means new, having been around for at least the last 20 years. What is new is the tremendous interest that it has generated over the last 12 to 18 months, allowing it to emerge from a small niche market to one that is well on its way to becoming mainstream.

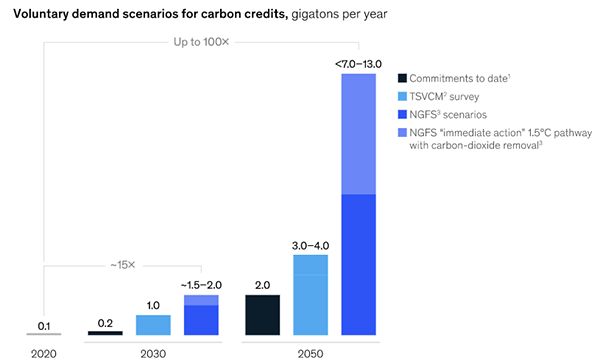

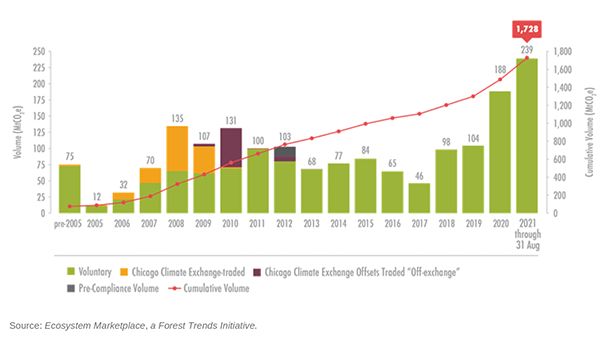

A recent report from Ecosystem Marketplace has indicated that transactions in the voluntary market may exceed $USD 1bn for the first time in 2021. While this figure is relatively small, it would represent a doubling in transactions year-over-year. Perhaps more telling are growth projections; McKinsey, the strategy consultancy, released a forecast predicting a potential 15x increase in market size by 2030, with a corresponding value of over $50bn.

Market forecasts aside, what is clear is that carbon offsets are going to play an important role in helping companies and countries meet near-term net-zero commitments and will be a key enabler in a more economic transition to a low-carbon economy. This article introduces readers to the voluntary carbon market, drivers of growth, risks and opportunities and, finally, recent developments that will help facilitate this growth.

What are carbon offsets?

Carbon offsets result from projects that either reduce greenhouse gasses (GHG) entering the atmosphere (e.g. energy efficiency), or projects that remove GHG from the atmosphere (e.g. forestry). Voluntary carbon offsets, as the name suggests, are not part of a regulatory or compliance program. They are, however, developed within the framework of a voluntary standard which prescribes methodologies and processes through which offsets can be created, ultimately verifying and serializing offsets on a registry. As such they can be thought of as ‘verified offsets'.

Voluntary carbon offsets and markets do not share a unified standard; there are, instead, a number of well-established offset standards (e.g. Gold Standard, Climate Action Reserve, Verra, etc.) through which offset projects are developed. Within each standard there are also a variety of different offset types, or protocols, that may align with an entity's corporate values or broader ESG initiatives. Some offset types may also provide additional attributes or co-benefits. For example, a forestry project represents a GHG removal type of offset project, while also providing ecosystem benefits (e.g. habitat).

Voluntary carbon markets can be accessed through trading platforms, brokers, or directly with offset project developers. Once serialized and on a registry, voluntary offsets may be bought and sold by different parties, with ownership changing hands on the respective registries. Buyers may also choose to have offsets retired on their behalf.

What Is Driving Growth In The Voluntary Carbon Market?

Fundamentally, growth in the VCM market is driven by growing concerns about climate change and the pressing need to take action. The concerns are clearly evidenced by the over 200 countries that have joined the 2015 Paris Agreement, setting goals to reduce GHG emissions in order to limit global warming to 1.5°C above pre-industrial levels.

These commitments and targets are spurring both sovereigns and corporations to make net-zero commitments. To date, more than 1,000 companies and 137 countries have made net-zero commitments.

A net-zero commitment involves a nation or organization setting a goal to either eliminate, or offset, emissions from their economy and/or business by a specific date, typically not later than 2050 and often much sooner. In the short-term, many organizations making commitments are looking to the voluntary carbon market while, at the same time, exploring longer-term options. This growing aggregate demand for offsets is clearly evident in the volume of transacted voluntary carbon offsets.

As noted earlier, the growth projections for voluntary offset imply a very rapid scaling of the market. This will bring with it unique challenges as well as risks and opportunities.

What Opportunities Does The Voluntary Carbon Market Present?

For entities that have made net-zero commitments, the voluntary offset market represents an avenue for addressing GHG reduction targets, materially internalizing the price of carbon, and supporting technology innovation, all while removing the lowest cost GHG emissions from the economy first.

Another key benefit of engaging with the voluntary market is building capacity. Over 20% of the world's economy is now covered by a carbon pricing regime and often one that provides for the use of flexible mechanisms such as offsets. Thus, developing the capability to interact with and have a finger on the pulse on the carbon market will be an increasingly important corporate competency, whether in support of new investments, M&A activity, or simply quantifying risks in order to disclose in line with the Task Force on Climate-Related Financial Disclosure (TCFD).

What Challenges Does The Voluntary Carbon Market Present?

Challenges are present in the voluntary market, both perceived and actual. The effectiveness of offsets, perceptions of ‘greenwashing', and the additionality of the projects themselves are frequently raised critiques of carbon offsets. In truth, this scrutiny is an important component to strengthening the voluntary offset market and ensuring its integrity and credibility.

General criticisms of offsets aside, an entity looking to purchase offsets should be able, or have a third party available, to identify voluntary offsets that meet their criteria (e.g. type of offset, geography, vintage, etc.) and conduct due diligence on the underlying project if necessary. This is significantly aided by registries that are maintained by the respective offset standards, which ensure that much of the information is publicly available.

Other challenges with the voluntary market include illiquidity, market opacity, scale and the general lack of an overarching standard. While the first two items will be addressed by the emergence of trading platforms, the issue around scale and standards are beginning to be addressed by private industry efforts. To this end, the Taskforce for Scaling the Voluntary Carbon Markets (TSVCM), an initiative spearheaded by former Bank of Canada Governor Mark Carney, has broad industry support and is beginning its work to bring greater homogeneity to the voluntary markets.

Outlook For The Voluntary Carbon Markets

The rapid growth of the voluntary market over the last 12-18 months has been a welcome development for near-term action to address climate change. Equally welcome has been the increasing convergence of carbon markets and sustainable finance, with each having historically operated more or less independent of the other.

Convergence enables companies to begin to make concrete plans to address GHG emission in the near-term while exploring longer-term opportunities to achieve lower emissions targets within their own businesses or supply chains. Setting internal reduction targets provides important benchmarks for certain types of climate finance, such as sustainability linked bonds and loans, which can result in a preferential cost of capital. Additionally, the $USD43tn in AUM represented by the signatories to the Net Zero Asset Managers Initiative is creating a compelling rationale for companies to begin to address their GHG emissions to align with investor expectations.

Alignment has also brought with it a greater number of market participants, a greater diversity of strategies and more capital available to finance offset projects. This increased market demand will, in turn, require the voluntary offset market to rapidly scale to deliver high-quality, quantifiable and verifiable offset projects. The work of the Taskforce on Scaling the Voluntary Carbon Markets could potentially play a critical role to this end and help to commoditize the voluntary market in the process.

Mainstreaming voluntary carbon markets is an exciting development. Greater price transparency, improved liquidity in both physical and derivative products and improved market infrastructure to simplify transactions will open the voluntary market to a broader swath of market participants and, in so doing, ensure that the voluntary market's next 20 years materially contribute to addressing climate change.

Author Bio

Andrew Hall

andrew.hall@tmx.com

Director, Sustainable Finance, TMX.

Andrew is the Director, Sustainable Finance at TMX Group. He has been involved in sustainable finance and carbon markets for over 15 years. In his current role, he is responsible for developing ESG and environmental commodity products and markets, as well as executing TMX Group's net-zero strategy.

Copyright © 2021 TSX Inc. All rights reserved. Do not copy, distribute, sell or modify this document without TSX Inc.'s prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. The Future is Yours to See., TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, TSX Venture Exchange, TSXV and Voir le futur. Réaliser l'avenir. are the trademarks of TSX Inc.