Create Disclosure

The importance of ESG disclosure is evident - external pressures for more sustainable practices are balanced with the internal benefits of adopting a sustainable practice. Through an ESG-lens, companies are finding cost-savings, new innovations, preferential finance terms, as well as new customer and employee attraction and loyalty.

Toronto Stock Exchange (TSX) and TSX Venture Exchange (TSXV) regularly consult with their stakeholders to discuss the evolving sustainability, governance and disclosure standards. This includes engagement with the International Sustainability Standards Board (ISSB), the Canadian Sustainability Standards Board (CSSB), and the Canadian Securities Administrators (CSA) on the national adoption of standards appropriately calibrated for Canadian capital markets.

To help issuers with their sustainability journey, TSX and TSXV recommend the voluntary use of an international standard such as those by the ISSB and CSSB. TSX and TSXV are committed to continue to create specialized resources to assist with ESG disclosure.

Often the question of where to start is asked by issuers. Three concepts are often discussed first:

- A materiality assessment to understand the sustainability concerns and issues top of mind within your company and sector from stakeholders both within and outside your company.

- Governance structure to ensure there is sufficient oversight and accountability to best address the sustainability issues and the strategies to address them.

- For climate specifically, an operational greenhouse gas (GHG) assessment to baseline emissions and identify where and how to look for emission reductions.

TSX has entered into an agreement* with Carbonhound Inc., a Canadian-owned business that specializes in GHG emission assessment tools and accounting solutions; their primary tool provides clients with a self-service, guided platform for assessing and calculating Scope 1, 2 or 3 emissions. Through this collaboration, TSX and Carbonhound will develop thought-leadership and tools to assist Toronto Stock Exchange and TSX Venture Exchange issuers with climate reporting and GHG emissions assessments.

*This publication is not an invitation to purchase Carbonhound Inc.’s services or products.

Benefits of ESG Disclosure

Additional Disclosure Resources

Primer on Environmental & Social Disclosure

Practical steps to assess and report financially material Environmental and Social factors

ESG 101

Centralized hub of issuer-relevant ESG-related contacts, articles, podcasts, videos, events and resources

Growth Accelerator Program

Sign-up for a complimentary one-on-one education session on ESG Disclosure best practices and trends.

Access Learning Resources

ESG 101 is an evolving hub of complimentary resources curated for issuers by TMX and by many of Canada's leading ESG experts.

Key Benefits

Our complimentary Growth Accelerator Program provides companies of any size or stage of listing with guidance and best practices on ESG Disclosure and a variety of other topics.

Key Benefits

Our Sustainability Reporting Practices for New Reporters offers issuers with overarching guidance that can be used when first forming ESG disclosure, or as a final review before publication.

Key Points

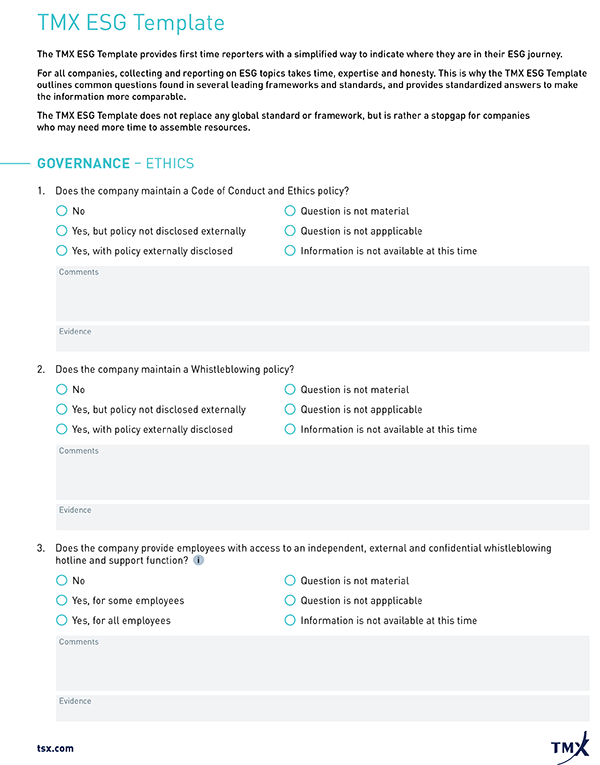

The TMX ESG Template is a very simple ESG reporting tool for companies who are just starting their ESG disclosure with few in-house resources. The Template has been curated to ask only questions that are common among other global frameworks and creates comparable data with succinct answers for stakeholders.

Key Benefits

Our Primer on Environmental & Social Disclosure helps listed issuers get started with, or enhance their ESG disclosure by first considering the financially material environmental and social aspects of their businesses.

Key Benefits

Obtain Insights

ESG Market Data

The TMX ESG Data Hub offers insightful environmental, social and governance data to empower investment communities to make well-rounded and informed investment decisions beyond.

TMX has partnered with premier Environmental, Social and Governance (ESG) data and analytics providers to deliver ESG data to its global clients including investors and corporations with information to support their investment decision-making processes and perform corporate peer analysis. TMX ESG Data Hub is a one-stop shop for ESG data and is delivered leveraging TMX Datalinx existing data delivery platforms which are used by investors globally.

Take a look at the ESG Data Hub webpage for further information.

Carbon Offsets

More companies are joining the global push to reduce emissions and reach net zero targets. The Voluntary Climate Marketplace (TVCM) helps companies reach those ambitions, offering a broad suite of voluntary carbon offsets on a best-in-class trading platform.

Key Benefits

For further information, contact Brenda Cunnington.