Back to the Learning Academy.

Webinar Recap: Unleashing the Power of Retail

TMX recently hosted a webinar with Peterson Capital called Unleashing the Power of Retail for public company CEOs wanting to learn how to expand their reach to retail Investment Advisors and their clients.

The number one question fielded at the webinar was how to get inside the office of an Investment Advisor as he or she deals with a multitude of issues, each of which is pulling them in a different direction, and causing distractions during the day?

Here are the three key ways to achieve that, as highlighted in the webinar by Rick Peterson, Founder & Chair of Peterson Capital:

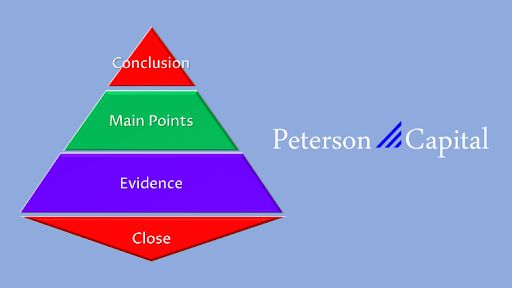

- Client presentations – no more than 17 pages in a presentation, and all constructed in a strict format that follows this pyramid below, and is summarized as well in a two-page Fact Sheet.

- CEO delivery – as CEO, you need to know how to concisely deliver your pitch without going into the weeds, getting too technical, or assuming that the IA knows as much as you do. Believe us, they don't. Your presentation skills are 80% of the reason an IA will take an interest in our story. This is harder than it appears – and you need training to get it right.

- Video – yes, we live in a digital world, but 98% of the video content sent out by public companies is never viewed. Why? Because it's too long, too detailed, and too boring. Keep in mind, the capital markets audience – be it IAs, fund managers, investment bankers or family office CEOs don't have time to spare. The answer is this: you must know how to make a video of no more than 60-seconds that tells your complete story and summarizes the key points made in the pyramid above.

The key message: Shorter is better. Being concise and impactful in a minimum amount of time is the key to IR messaging.

For additional tips on targeting retail investors, see Buyside Breakdown Part 1: Retail Investors.