Back to the Learning Academy.

Sector Analysis of Board Diversity on Toronto Stock Exchange Listed Companies

On The Board | A 4-part series

On The Board is a 4-part series of data-driven insights and analysis based on company research of public companies listed on Toronto Stock Exchange

- Part 1: Overboarding: An Analysis on Toronto Stock Exchange Listed Companies

- Part 2: Sector Analysis of Board Diversity

- Part 3: Diversity of Executive Management Teams

- Part 4: Sustainability at the Board

*Unless otherwise indicated, statistics compiled and provided by MarketIntelWorks On The Board Tracker.

Part 2 | Sector Analysis of Board Diversity on Toronto Stock Exchange Listed Companies

The topic of diversity in corporate boardrooms has come to the fore in Canada and around the world. Diversity within the Board of Directors is seen as a source of real competitive advantage. The focus of this article and analysis will be on board diversity in gender and ethnicity/BIPOC of Toronto Stock Exchange (TSX) listed companies although it is well understood that diversity takes many other forms in a boardroom.

Increasing Diversity at the Board Level: Background

At the end of 2014, the Canadian Securities Administrators implemented new corporate disclosure rules aimed at increasing gender diversity on boards and executive management positions. The rules follow a "comply or explain" model and relate to the following five areas:

- Actual Representation: the number and proportion of directors who are women.

- Targets: whether the issuer has adopted a target for the number of women on its board.

- Policies and Objectives: a summary of the objectives of any written policy relating to the identification of women directors.

- Hiring Process: whether, and if so how, the issuer considers the level of representation of women on the board when identifying new candidates or making appointments.

- Board Renewal: a description of any term limits for directors or other mechanisms for board renewal.1

Fast forward to January 1, 2020, and Canada became the first jurisdiction in the world to require diversity disclosure beyond gender.2 Corporations governed by the Canada Business Corporations Act (CBCA) with publicly traded securities (in 2020, approximately 670 companies on combined TSX and TSX Venture Exchange)3 are required to provide shareholders with information on diversity on the board of directors and executive management teams. This disclosure follows the same "comply or explain" approach and requires disclosure on the representation for women, Aboriginal persons, persons with disabilities, and members of visible minorities.

The introduction of the "comply or explain" disclosure rules on gender has led to the development of initiatives and groups that engage with corporate Canada to commit to certain diversity targets on boards and executive management teams.

For example, the 30% Club, which is a global business campaign aiming to boost the number of women in board seats and executive leadership of companies all over the world.4 Their mission is to campaign for at least 30% representation of women on all boards and executive management teams globally. In Canada the aim of the 30% Club is to include both board Chairs and CEOs as members with a commitment to achieve better gender balance at board level, as well as at senior management levels. In June 2021, for the first time, the S&P/TSX Composite Index* met and surpassed the goal of 30% women on boards.

BlackNorth Initiative started in July of 2020 and, similar to the 30% Club, their aim is to include both board Chairs and CEOs to foster inclusiveness for Black leaders at the board level, as well as at executive management levels. BlackNorth's goal is to get the combined board and executive team roles held by Black leaders up to 3.5% by 2025.5

Analysis: Diversity on Boards of TSX-Listed Companies

The saying "what gets measured, gets done" has proven true in the instance of board diversity:

- Since the disclosure rules on gender were introduced, the percentage of women on boards at all TSX companies has gone from 12% in 2015 to 24% in 2021 and from 18% in 2015 to 32% in 2021 at S&P/TSX Composite Index companies.

Table: Women on Boards: Progress Since "Comply or Explain" Disclosure Rules Introduced

| 2015 | 2018 | 2019 | 2020 | 2021 | |

| All TSX Listed Companies | 12.0% | 17.2% | 19.4% | 21.6% | 23.8% |

| S&P/TSX Composite Index Companies | 18.3% | 24.6% | 27.6% | 29.9% | 31.7% |

- Since July 2020 when the diversity disclosure rules went beyond gender for issuers subject to the CBCA, the percentage of BIPOC on boards at all TSX companies (not just those under CBCA) went from 5.2% to 7.5% in 2021 and from 4.2% to 7.7% in 2021 at S&P/TSX Composite Index companies.

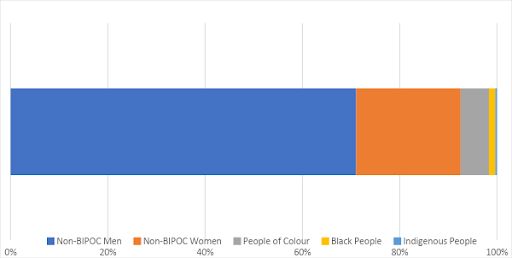

- As at December 31, 2021, women and BIPOC together represented 29% of the 6,163 board director positions on TSX-listed companies. Non-BIPOC men represented 71%.

Sectoral Analysis: Gender Diversity on Boards

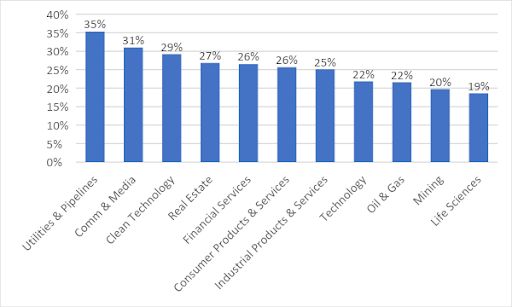

Gender diversity on boards varies widely by sector with Utilities & Pipelines, Communications & Media, and Clean Technology being the most gender diverse and Technology, Oil & Gas, Mining and Life Sciences being the least gender diverse. What sets the Utilities & Pipelines sector apart? A recent study by the law firm Osler suggests that Utilities & Pipelines companies do not restrict their women director searches to their own sector.6 The companies in this sector also tend to be larger and many are included in the S&P/TSX Composite Index which attracts scrutiny on ESG topics like diversity by institutional investors and proxy advisory firms.

Historically, Technology, Mining, and Oil & Gas have been all-male or almost all-male sectors. Women have been under-represented in these STEM sectors. According to Statistics Canada, 34% of Canadians with a STEM degree are women and they make up only 23% of Canadians working in STEM jobs.7 As a result, the pool of candidates has been small and women in these sectors did not have the visibility or the network to be put on long lists for director searches. However, the news is not all bad for the least gender diverse sectors. Technology, Oil & Gas and Mining have had the biggest increases in the number of women on their boards since 2015 with all three sectors more than doubling their women on board percentages.

Percentage of Women on Boards by Sector, 2021 Snapshot

Sectoral Analysis: Ethnic/BIPOC Diversity on Boards

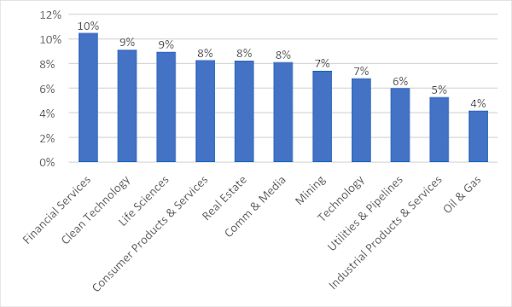

Following gender diversity, the focus on ethnic and BIPOC diversity on boards has increased recently but the collection of data on this group is still nascent and as a result, we don't have several years of data to analyse. In 2021, Financial Services was the sector leader by BIPOC board representation and Oil & Gas was the least ethnically diverse sector. Mining, with the largest number of companies in its sector, ranks higher for ethnic diversity than for gender diversity.

Percentage of BIPOC on Boards by Sector, 2021 Snapshot

Progress Beyond 2022

The 2022 proxy season has seen leading proxy advisory firms issue stricter requirements on board gender diversity for TSX-listed companies. Additionally, the European Council and European Parliament announced on June 7th a new EU law promoting a more balanced gender representation on the boards of listed companies.8

Ethnic/BIPOC diversity is a focus as well. Nasdaq introduced a board diversity disclosure requirement to start on August 22nd, on the demographics of the board of directors of Nasdaq-listed companies, not only on gender but underrepresented minorities or members of the LGBTQ+ community.9 In Canada, the Capital Markets Modernization Taskforce in 2021 launched by the Ontario government, recommended that the Ontario securities legislation be amended to require publicly listed companies to set targets, timelines and report data annually in relation to representation of those who self-identify as women, BIPOC, persons with disabilities or LGBTQ+.10

To prepare for mandates and/or to avoid criticism, companies in all sectors need to be more focused on how they fill vacant board seats. Having a strong recruitment process to capture a wide pool of candidates can help, along with board refreshment mechanisms like term limits, board renewals, evergreen lists from advance strategic assessments of board competency and experience needs.11 Board candidates sourcing could involve:

- Considering Executive Management team members at larger companies in the same sector as candidates for a director position at a smaller company

- Looking outside a company's current sector for a more varied pool of qualified candidates

- Hiring a Chief Diversity Officer to ensure staffing within all ranks of an organization are representative, especially within the Executive Management level, who gain knowledge useful for future board membership

- Obtaining graduate lists from board training organizations; general programs as well as specialized education programs e.g. gender-specific, skill-specific

- Mentoring individuals to prepare them future senior-level or board positions

Tapping larger pools of diverse candidates for consideration is the first step towards greater gender and ethnic/BIPOC diversity on boards. A diverse candidate can only get on the board if they are on the long list of potential directors first.

For related articles, take a look at the resources below, or sign up to receive our Learning Academy newsletter:

- Overboarding: An Analysis on Toronto Stock Exchange Listed Companies

- Setting the Tone from the Top: A Conversation about Diversity on Boards

- In Courage

- What your peers are accessing about your ESG data

- ESG From the Top

About MarketIntelWorks

Gina Pappano is the Founder of MarketIntelWorks Inc., a data research and analytics company with a focus on gender diversity plus BIPOC (Black, Indigenous, People of Colour) on Boards and Executive Management Teams of TSX listed companies. MarketIntelWorks On The Board Tracker is a comprehensive diversity tracking tool in Canada. Not only do we have the stats with respect to Gender, Visible Minority, Indigenous and Black representation on Boards and Executive Teams, we also have the names of the people behind the stats. Marketintelworks.com

Footnotes

-

McMillan, David Andrews, October 2014, https://mcmillan.ca/insights/new-disclosure-rules-for-women-on-boards-for-the-2015-proxy-season/

-

Osler, Jennifer Jeffrey, Andrew MacDougall, John M. Valley, July 30 2019, https://www.osler.com/en/resources/regulations/2019/canada-is-first-jurisdiction-worldwide-to-require-diversity-disclosure-beyond-gender-diversity-disc

-

CBCA, 2021, https://www.ic.gc.ca/eic/site/cd-dgc.nsf/eng/cs08998.html#s21

-

30% Club, https://30percentclub.org/about-us/

-

Financial Post, a division of Postmedia Network Inc., Barbara Shecter, February 23 2022, https://financialpost.com/fp-work/blacknorths-wes-hall-says-pace-to-get-more-black-leaders-on-boards-is-falling-way-short-of-expectations

-

Osler, October 13 2021, https://www.osler.com/en/resources/governance/2020/diversity-among-directors-and-executives-in-canada

-

Randstad, March 7 2022, https://www.randstad.ca/employers/workplace-insights/women-in-the-workplace/women-in-stem-where-we-are-now/#:~:text=The%20numbers%20are%20similar%20in,working%20in%20science%20and%20technology

-

Council of the EU, 7 June 2022, https://www.consilium.europa.eu/en/press/press-releases/2022/06/07/council-and-european-parliament-agree-to-improve-gender-balance-on-company-boards/

-

INSEAD, Felicia A. Henderson, Zoe Kinias, Claudia Zeisberger, December 22 2021, https://knowledge.insead.edu/blog/insead-blog/how-nasdaqs-board-diversity-rule-creates-potential-for-real-change-17961

-

Government of Ontario, January 2021, https://www.ontario.ca/document/capital-markets-modernization-taskforce-final-report-january-2021

-

Egon Zehnder, October 12 2016, https://www.egonzehnder.com/what-we-do/board-advisory/insights/evergreen-board-succession-planning

Copyright © 2022 TSX Inc. All rights reserved. Do not copy, distribute, sell or modify this document without TSX Inc.'s prior written consent. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this article, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This article is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. The Future is Yours to See., TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, TSX Venture Exchange, TSXV and Voir le futur. Réaliser l'avenir. are the trademarks of TSX Inc.

*The S&P/TSX Composite Index (the "Index") is the product of S&P Dow Jones Indices LLC or its affiliates ("SPDJI") and TSX Inc. ("TSX"). Standard & Poor's® and S&P® are registered trademarks of Standard & Poor's Financial Services LLC ("S&P"); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC ("Dow Jones"); and TSX® is a registered trademark of TSX. SPDJI, Dow Jones, S&P, their respective affiliates and TSX do not sponsor, endorse, sell or promote any products based on the Index and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions or interruptions of the Index or any data related thereto.