Back to the Learning Academy or ESG 101.

Buyside Breakdown Part 2: Exchange Traded Funds

Buyside Breakdown | A 4-part series

Buyside Breakdown examines four types of investors, their influence on listed companies, and tactics to target them. In conjunction with our earlier series Leaving a Trail for Investors to Find You, listed companies have a comprehensive set of resources to better understand and attract investors.

- Part 1: Retail Investors

- Part 2: Exchange Traded Funds

- Part 3: Family Offices

- Part 4: Pension and Sovereign

Part 2: Exchange Traded Funds (ETFs)

As a buyside segment, ETFs can have a significant impact on their company constituents. Companies that are part of an recognized index and subsequently tracked by a passive ETF may benefit from increased liquidity and market capitalization. With significant growth in the number of active ETFs, there is hope for other companies to capture the interest of ETF asset managers1.

In Canada, the split between active and passive funds is approximately 50/502, in a world where passive ETFs typically dominate the landscape. In the US, roughly 6% of ETFs are actively managed. However US active ETFs accounted for 25% of the new money from investors in the first 9 months of 20233. In Europe, active ETFs have increased by 92% between 2016-20224. ETFs are generally more appealing to investors during volatile markets. This may further encourage the growth of active ETFs with the recent socio-economic turmoil in our markets5. Both the growth and appeal of ETFs may result in an opportunity for increased investor relations engagement with active ETF asset managers.

ETFs Defined

ETFs are an investment vehicle that tracks a portfolio of assets (e.g. commodities, bonds, equities, indices). ETFs are traded on secondary markets and are priced and traded throughout the business day. Generally ETFs are divided into two categories:

- Passive: typically tracks an index. Holdings change to reflect the referenced index

- Active: can track an index or another basket of securities based around an investment objective or strategy and looks to outperform the referenced basket by monitoring market conditions to act accordingly

ETF Market Statistics

- The first global ETF was created by Toronto Stock Exchange in 1990 called the Toronto 35 IndexⓇ Participation Units, or TIPSⓇ for short.

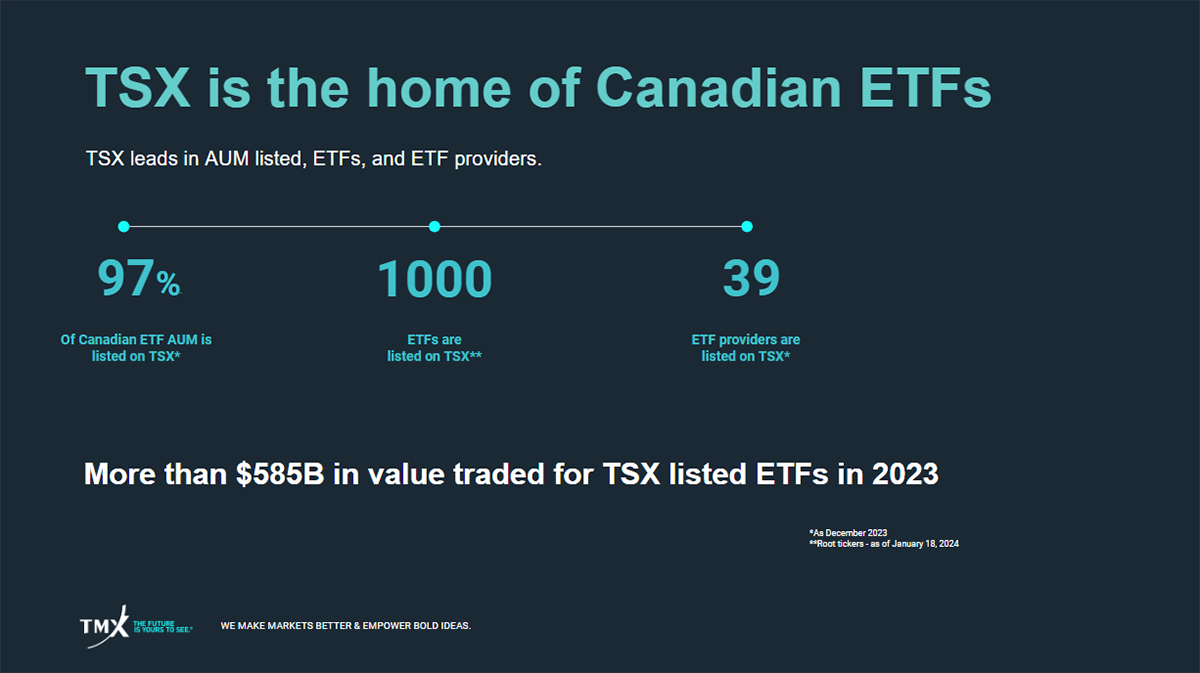

- As of January 31, 2024, there were 1000 ETFs listed on Toronto Stock Exchange with more than $585B in traded value.

- In 2022, actively managed ETFs dominated the new launches in Canada with 72% of new products that do not track a published index5.

- In the US and Europe, ETFs have grown almost three times faster than traditional mutual funds since 20106.

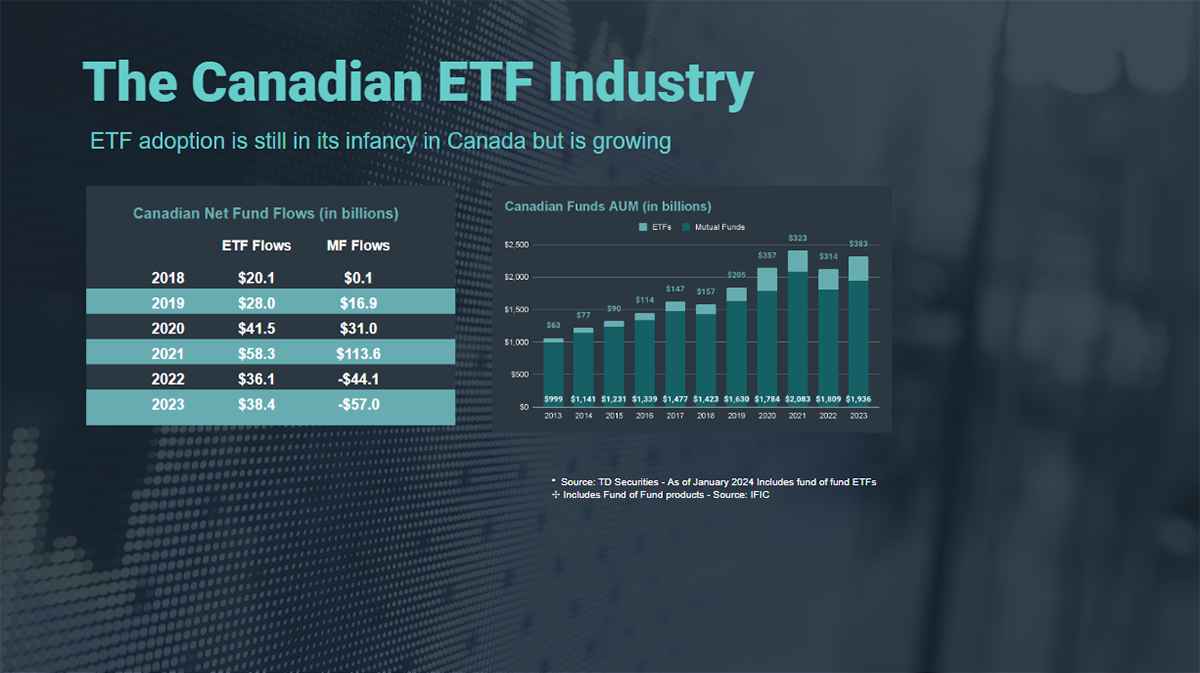

- In Canada, greater net fund flows are going into ETFs over mutual funds.

Source: TMX

Why ETFs Matter

Buying Power

National Bank Financial reports that while ETFs still lag in terms of inflows of capital compared to mutual funds, in volatile markets, ETFs appeal to investors over mutual funds because of their intra-day liquidity, their lower costs, and greater transparency5.

The growth of ETFs cannot be ignored. As at December 31 2023, on Toronto Stock Exchange alone, there were 1000 ETFs listed, representing $585B in value traded. With a growing amount of capital funneling into ETFs, we may expect to see even greater product specialization.

Trading Impact

ETFs may have impacts on equity trading. The constituents of a passive index-tracked ETF may expect increased trading activity during the onboarding and offboarding from an index, as well as during the index's "rebalancing" periods7. For example, the S&P/TSX Composite Index* is rebalanced quarterly - effective after the close following the third Friday in March, June, September, and December8. It is therefore important for listed companies held by ETFs to understand the index methodology and rebalancing schedule to anticipate any increased trading activity and the implications to the companies' stock price.

Additionally, it is possible with passive equity ETFs that market makers need to hedge the index's underlying stocks5. Hedging in liquid stocks has minimal impact on the pricing of the underlying stocks. Even for niche ETFs holding more illiquid securities, the impact on underlying securities is still considered muted5.

Active ETF constituents will have similar predictability in terms of trading activity although portfolio managers have the ability to shift holdings based on market conditions. Active management may include the rotation of sectors to shield investors from periods of volatility9. However big swings in holdings are rare because they must stay within the confines of their investment strategy.

Influence

One way ETFs have influence over companies is in terms of fund construction. An ETF provider can choose to create a passive or active equity ETF which ultimately influences whether the fund has any control over the equity asset constituents. Further, fund providers may create ETFs that use screening techniques, or construct a fund around a theme (thematic funds) to appeal to a wider range of investors. Themes and construction techniques can further influence the constituents or influence the individual weightings of the constituents within a fund.

A second area of influence is shareholder proxy voting. ETF providers act as fiduciaries of clients' assets through their stewardship teams engaging with companies and voting on proxies. The voting power for constituents of index-tracking ETFs has been concentrated among large ETF asset owners10. Typically, ETF fund managers cast votes on shareholder proposals on behalf of their clients, who are the actual owners of the ETF shares. In the US, it is estimated that BlackRock, State Street and Vanguard control between 15 percent to 20 percent of most large US public companies because of their number of funds11. However, in the last two years, there has been some change. Blackrock was the first to allow ETF shareholders proxy voting on held funds. This change enabled eligible institutional clients as well as retail investors to vote on some of their ETFs12; generally referred to as pass-through voting13.

How to Identify ETF Holdings

ETFs are transparent in their holdings:

- Passive ETFs are a replication of the referring index. Generally index providers publish their constituents. However, the percentage weighting of each constituent company may not be publicly available.

- Active ETFs in Canada only have to report top 25 holdings quarterly to the public14. In the US, ETFs must report holdings daily if they have non-US holdings15.

- The ownership module on TSX InfoSuiteⓇ can be used by issuers to determine the North American ETFs and mutual funds holding their stock or a peer.

How to Engage and Access ETFs

There isn't a reason to target passive ETFs, but companies may want to consider looking at how to gain access to active ETF managers. With greater money flowing from active mutual funds to active ETFs, some value might be achieved by looking at actively managed Canadian equity ETFs.

Active ETFs provide more insight and transparency regarding their objectives than active mutual funds. This means companies could theoretically tailor their pitch to ETF portfolio managers. It is therefore important to build relationships with active ETF managers and consider highlighting liquidity or market capitalization within your investor decks.

TMX Support

- Review our Educational Resources: Index Inclusion article for information on our S&P/TSX Indices and their effects on trading or listen to our Cause and Effect podcast

- Research ETF Ownership: Issuers can use the ownership module on TSX InfoSuite to see the North American ETFs and mutual funds that are holding their stock or a peer

- Research our indices: For details on our indices, take a look at our webpage S&P/TSX Index methodologies

- Target ETFs: Take a look at the TSX ETF Investor Centre on TMXMoneyⓇ to research and target active ETFs

Footnotes

-

The Impact of ETF Index Inclusion on Stock Prices, Social Science Research Network, John Duffy, Daniel Friedman, Jean Paul Rabanal, Olga Rud, May 24, 2022,

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4061686. -

Active ETF activity grows, Investment Executive, Melissa Shin, October 11, 2022,

https://www.investmentexecutive.com/newspaper_/etf-guide-2022/active-etf-activity-grows/#:~:text=More%20active%20ETFs%20have%20launched,lower%20than%20for%20passive%20ETFs. -

Capital Group bets big on fully transparent active ETFs, Pensions&Investments, Ari I. Weinberg, November 6, 2023,

https://www.pionline.com/exchange-traded-funds/capital-group-bets-big-fully-transparent-active-etfs. -

Why ETFs are set to dominate fund assets, Wealth Professional, Jean Dondo, May 8, 2023,

https://www.wealthprofessional.ca/investments/etfs/why-etfs-are-set-to-dominate-fund-assets/375732. -

Canadian ETF Flows, National Bank of Canada, Daniel Straus, January 5, 2023,

https://nbf.bluematrix.com/sellside/EmailDocViewer?encrypt=72d5702c-0270-4406-9463-e44e70dec4c8&mime=pdf&co=nbf&id. -

The Renaissance of ETFs, Oliver Wyman, Kamil Kaczmarski, Sean Farrar, Philipp Zelter,

https://www.oliverwyman.com/our-expertise/insights/2023/may/exchange-traded-funds-are-fueling-market-opportunities.html. -

When the boat rocks: trading during an index rebalancing — Quant Simplified, Medium, Finsinyur, December 27, 2023,

https://caden-finsinyur.medium.com/when-the-boat-rocks-trading-during-an-index-rebalancing-quant-simplified-3f00f53aa4f0. -

Index Inclusion, TMX Group, April 14, 2022,

https://www.tsx.com/company-services/learning-academy?id=578&lang=en. -

Passive ETF: What It Means, How It Works, Investopedia, Daniel Liberto, January 26, 2024,

https://www.investopedia.com/terms/p/passive-etf.asp. -

ETFs' Growing Proxy Power, ETF.com, Jessica Ferringer, January 19, 2022,

https://www.etf.com/sections/features-and-news/etfs-growing-proxy-power. -

From the Financial Times. August 28, 2023. Vanguard's backing for green and social proposals falls to 2%. Madison Darbyshire, Brooke Masters. © The Financial Times Limited 2013. All Rights Reserved.

https://www.ft.com/content/4313afe4-1fee-447d-b05b-0c8c38cfbff1. -

Empowering investors through BlackRock Voting Choice, BlackRock,

https://www.blackrock.com/corporate/about-us/investment-stewardship/blackrock-voting-choice#:~:text=BlackRock%20has%20seen%20growing%20interest,more%20accessible%20for%20eligible%20clients. -

Pass-Through Voting, Broadridge Financial Solutions, Danielle Gurrieri,

https://www.broadridge.com/ca/article/wealth-management/pass-through-voting. -

ETFs in the spotlight: The CSA review exchange-traded funds, Borden Ladner Gervais LLP, Kathryn M. Fuller, Melissa Ghislanzoni, Lynn McGrade, Whitney Wakeling, Griffin Murphy, October 05, 2023,

https://www.blg.com/en/insights/2023/10/etfs-in-the-spotlight-the-csa-review-exchange-traded-funds. -

Active Semi-Transparent ETFs: What's Under the Hood?, Charles Schwab, Emily Doak, April 5, 2023,

https://www.schwab.com/learn/story/active-semi-transparent-etfs-whats-under-hood.

Copyright © 2024 TSX Inc. All rights reserved. Do not copy, distribute, sell or modify this document without TSX Inc.'s prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this article, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This article is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. The Future is Yours to See., TIPS, TMX, the TMX design, TMX Group, TMX Money, Toronto 35 Index, Toronto Stock Exchange, TSX, TSX Venture Exchange, TSXV and Voir le futur. Réaliser l'avenir. are the trademarks of TSX Inc. All other trademarks used in this article are the property of their respective owners.

* The S&P/TSX Composite Index and the S&P/TSX Indices (the "Indices") are the products of S&P Dow Jones Indices LLC or its affiliates ("SPDJI") and TSX Inc. ("TSX"). Standard & Poor's® and S&P® are registered trademarks of Standard & Poor's Financial Services LLC ("S&P"); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC ("Dow Jones"); and TSX® is a registered trademark of TSX. SPDJI, Dow Jones, S&P, their respective affiliates and TSX do not sponsor, endorse, sell or promote any products based on the Indices and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions or interruptions of the Indices or any data related thereto.