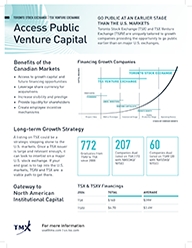

KEY BENEFITS FOR U.S. COMPANIES

-

1

Access to Capital

Going public can provide your company with financing opportunities to grow your business via expansion of operations, hiring or acquisitions.

-

2

Long-Term Growth

As a public company, your shares can be used as a currency substitute to acquire target companies, instead of a direct cash offering. Using shares for an acquisition can be a tax-efficient and cost-effective vehicle to finance such a transaction.

-

3

Increase Visibility And Prestige

Going public enhances your company’s visibility. Greater public awareness gained through media coverage, publicly filed documents and coverage of your shares by sector investment analysts can provide your company with a higher profile and greater credibility.

-

4

Provide Liquidity For Shareholders

Becoming a public company establishes a market for your company’s shares, providing your investors with an efficient and regulated vehicle in which to trade their shares.

-

5

Create Employee Incentive Mechanisms

Your employees can participate in the ownership of your company and benefit from being shareholders. Share ownership can have an immediate and tangible value to employees, and can be used as a recruitment incentive.

$6.1B

73

192

As at December 31, 2024.

Market Intelligence Report (MiG)

Provides year-to-date data on listings, financings and trading activity across Toronto Stock Exchange and TSX Venture Exchange, broken down by sector and region.

GET OUR MIG REPORTExplore this four-part video series on how to go public in Canada

Reason

Start your listing journey by considering reasons to go public and what the key benefits are, such as access to capital and acquisition currency.

Ready

Is your company ready to go public? This video outlines the readiness checklist such as who you need on your leadership team, market interest, and corporate governance standards.

Requirements

What are the requirements of going public? Hear how your listing candidacy is affected by financials and company history, number of shareholders, and board of directors.

Reality

While getting listed is the goal, you also need to prepare for the reality of operating as a public company. This video covers cost savings, tax implications, and alignment with growth goals.

GO PUBLIC - WAYS TO GET LISTED

There are multiple pathways to listing on TSX and TSXV.

TSX and TSXV Listed company initiatives

TSX VENTURE 50®

TSX Venture 50 is a ranking of the 50 top-performing companies on TSX Venture Exchange over the last year. Companies are ranked based on three equally-weighted criteria of one-year share price appreciation, market capitalization increase, and Canadian consolidated trading value.

Meet the top performers at https://www.tsx.com/venture50

TSX30

TSX30 recognizes the 30 top-performing companies on Toronto Stock Exchange, ranked based on dividend-adjusted share price performance over a three-year period. As our flagship program, it offers unique insight into important market trends and shines a light on compelling companies that have exemplified excellence in growth.

Explore the list at https://www.tsx.com/tsx30